Interest and penalties on late taxes

If you have an outstanding tax balance for a given year and failed to file your Canadian income tax return by April 30th, the Canada Revenue Agency will begin to impose compound daily interest starting on May 1st of that year on any remaining owed amount.

It is worth mentioning that the total amount owed includes any balance after the CRA reviews your return.

If you have outstanding amounts from previous years, the CRA will continue to impose compound daily interest on them.

When you make a payment, it will be applied to previous year's amounts first.

Interest on taxes you owe - tax instalments

Tax instalment interest

If the CRA requires you to pay tax instalments, you have to pay the instalments by the instalment payment due dates.

If you miss any of these payment due dates, you may have to pay instalment interest.

Tax instalment penalty

You may have to pay a penalty if your instalment payments are late or less than the required amount.

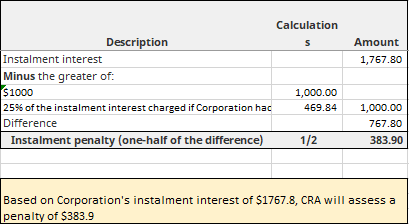

The CRA applies the instalment penalty only if your instalment interest charges for 2023 are more than $1,000.

You can download a free Microsoft Excel spreadsheet template below this article to calculate the CRA instalment interest & instalment penalty on your own.

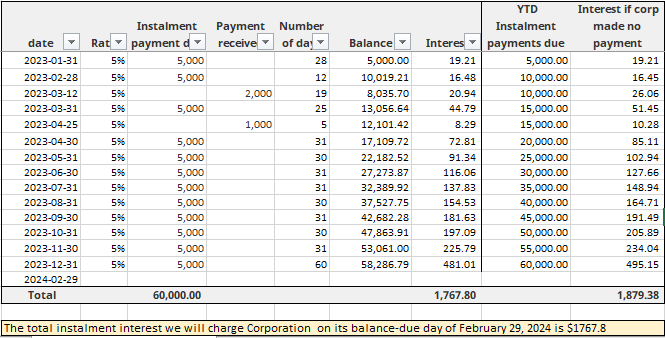

The illustration below shows the calculation of installment interest and penalty using the offset method by CRA.

Corporation, with a year-end of December 31, is required to make monthly installment payments of $5,000 starting in January 2023.

However, in the year, Corporation only made two payments:

one payment of $2,000 on March 12 and another payment of $1,000 on April 25.

As a result, when evaluating Corporation's tax return, CRA will assess $1,767.80 in installment interest.

Based on Corporation's instalment interest of $1,767.80, CRA will assess a penalty of $383.90.

This calculation was performed using a daily compounded underpayment interest rate of 5%.

Calculation of instalment interest

CRA uses the following formula to calculate the compound daily interest:

Balance*(1+Rate/365 days in a year)^(365/(365/Number of days))-Balance

Calculation of instalment penalty

You can determine the penalty for late payments on your own using the provided spreadsheet. Use the attached spreadsheet and enter the following information:

- monthly payment deadlines, including dates of installment payments received

- interest rate

- payment received by the CRA

The number of days, balance and interest will be calculated automatically.

Download a free Microsoft Excel spreadsheet template to

calculate the CRA instalment interest & instalment penalty.

Disclaimer:

“Please note that the information provided in this article is of a general nature and may not be accurate for your specific situation. The information is current as of the date of posting and is not intended to provide legal advice. It's always recommended that you consult with a professional accountant and lawyer for personalized guidance and advice."