Restricted Stock Units (RSUs) - tax implications for Canadian employees

Explore the tax implications of Restricted Stock Units (RSUs) for Canadian employees, from grant to sale, including taxable benefits, withholding taxes, and reporting requirements.

RSUs, or Restricted Stock Units (also known as restricted share units), are plans that provide units to employees based on the value of the company's shares. These units cannot be sold until specific conditions are met within a designated time period (often simply being employed by the company on the vesting date).

In this article, we will explore how RSUs are taxed for Canadian residents.

RSUs essentially serve as deferred employee bonuses.

Similar to emplyee stock options, there are no tax implications for employees when RSUs are granted.

However, when RSUs vest (when employees are able to sell them), employees receive a taxable benefit equal to the value of the shares or cash received, and the Fair Market Value (FMV) of the vested RSU grants is considered employment income.

Since 2011, the Canada Revenue Agency has mandated that employers withhold taxes on RSUs, meaning your employer sells a portion of the vested restricted stock and submits it to the CRA. The employer must report this benefit on the employee's T4 form, with the Fair Market Value (FMV) of the restricted stock sold and the taxes withheld added to the Employment Income (box 14 & 38) and Income Tax Deducted (box 22) of the T4 slip for the fiscal year.

Upon vesting, it's the responsibility of the employee to keep track of the Fair Market Value (FMV) of the restricted stock. If there are multiple vesting events, the adjusted cost base of the stock must be calculated.

When the stocks are sold at a later time, the difference between the proceeds from the sale and the adjusted cost base (ACB) of the shares must be reported on Schedule 3 Capital Gains (or Losses) on T1 tax return.

One option to delay paying the resulting capital gain is to sell the shares at a later time. However, this strategy carries the risk of a potential decline in the shares' value.

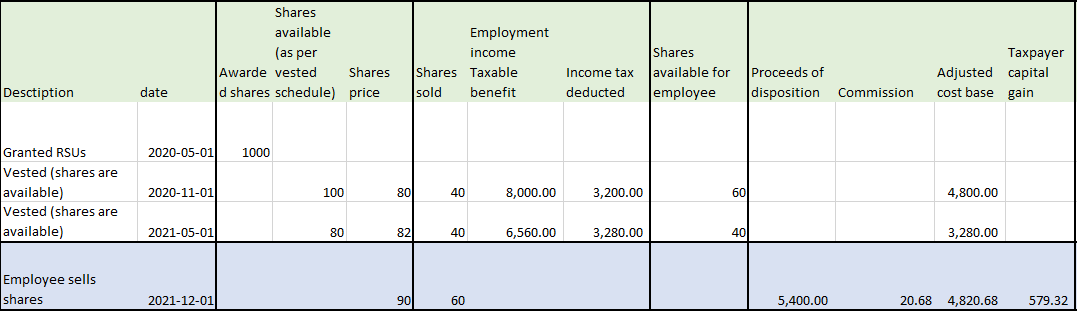

Consider the following example:

- An employee is granted RSUs on May 1, 2020, with no tax implications at the time of grant.

- On November 2020, 100 RSUs vest at a Fair Market Value of $80 per share. The employer calculates the taxable benefit, sells some shares to withhold taxes on RSUs, and reports the taxable benefit on the 2020 T4 slip.

- On May 2021, 80 RSUs vest at a Fair Market Value of $82 per share. The employer calculates the taxable benefit, sells some shares to withhold taxes on RSUs, and reports the taxable benefit on the 2021 T4 slip.

- On December 1, 2021, employee sells 60 shares at $90 per share and reports the resulting capital gain on Schedule 3 of 2021 T1 tax return.

The Excel version of the provided RSU template can be utilized for basic RSU calculations.

However, the provided example does not factor in more complicated scenarios where the variable values of shares are sold at a later point in time.

We can assist you with preparing your tax return for a more complex analysis of your RSUs. Please contact us via phone (604-727-1540) or email us at info@absfinances.com

Additional considerations:

It's crucial to distinguish RSUs from Restricted Stock Awards (RSAs), which are stock grants that prohibit employees from selling or transferring the shares until they vest, but still entitle them to dividend payments.

RSAs are not popular in Canada due to their tax treatment: the Fair Market Value (FMV) of the RSA grant is taxed as employment income at the time of grant, but employees only receive the cash from the sale after the grants vest, which could be several years later.

Disclaimer:

“Please note that the information provided in this article is of a general nature and may not be accurate for your specific situation. The information is current as of the date of posting and is not intended to provide legal advice. It's always recommended that you consult with a professional accountant and lawyer for personalized guidance and advice."