Tax-Free Motor Vehicle Allowances

Maximize tax efficiency in business travel with expert insights on motor vehicle allowances, and deductible strategies in Canada. Navigate consequences, stay informed, and make smarter financial decisions.

As per the Income Tax Act, employers can reimburse employees or officers (corporation directors) for business-related travel expenses incurred while using their personal vehicle as a tax-free payment, if the motor vehicle allowance is considered reasonable.

A motor vehicle allowance will be considered reasonable only if it is both:

• based solely on the number of kilometres driven (keeping Log Book required)

• computed using a reasonable per-kilometre rate.

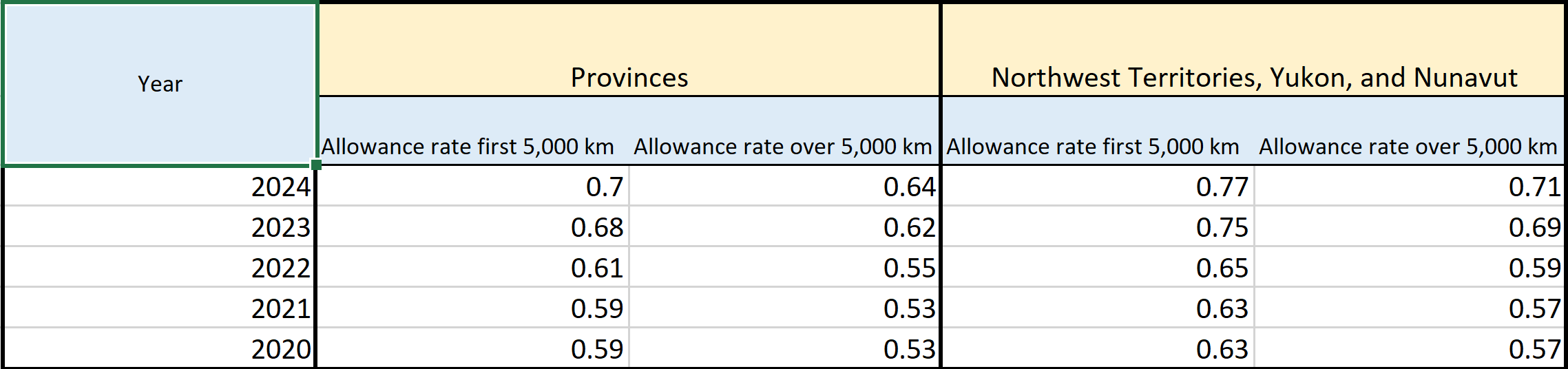

Prescribed rates for tax-exempt allowances:

Please download a free Vehicle Allowance Log Book Excel template that will automatically calculate your tax-free benefit by clicking the download button at the end of this article.

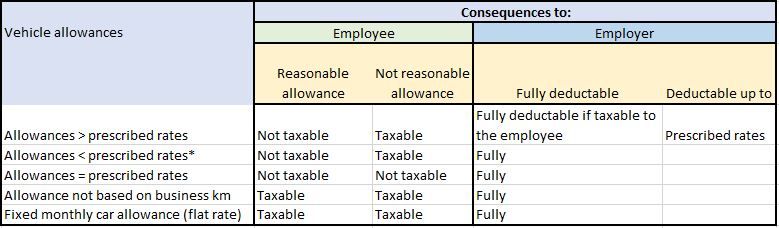

Consequences of automobile allowances to employees and employers

The general rule is that employers may deduct automobile allowances only up to the prescribed rates. However, this does not apply if the allowance is required to be included in the employee’s income.

There are also consequences to employees and vehicle allowance will be considered a taxable benefit if an employee or officer is paid the following:

- Fixed monthly car allowance (flat rate)

- Car allowance on a per-kilometre rate that is a much higher or lower rate than the reasonable per-kilometre rate set by the CRA

- Allowance that is not based on your actual business kilometres, but for example on expenses

- Partial vehicle allowance for business-related mileage

- An allowance that is a combination of flat-rate and reasonable per-kilometre allowance that cover the same use for the vehicle

Please see below the summary of consequences to employers and employees.

- CRA will allow it to be treated as tax free, even if normally treats an unreasonable low allowance as taxable*

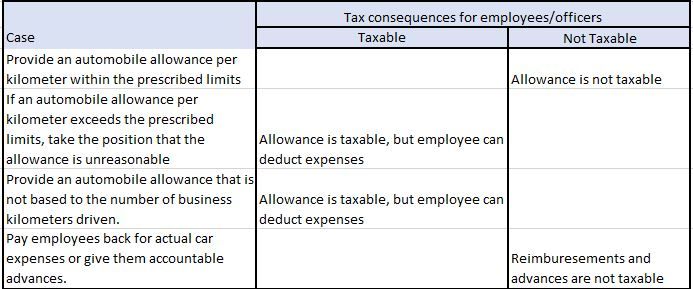

Strategies for automobile expenses

Employers that cover some or all of their employees' car expenses should explore the following options to claim a deduction for the amount paid

Income tax forms

An employee who claims automobile expenses regarding employment must complete Part A of Form T2200 (TP-64.3-V in Quebec) which must be completed and signed by employer.

The employee must file Form T777 (TP-59-V in Quebec) with his or her income tax return to support a claim for automobile expenses.

Additional considerations:

1) Self-employed individuals

Only actual operating expenses are deductible; a claim for expenses calculated on a cents-per-kilometre basis is not permitted.

2) Shareholders and partners

If a shareholder or a partner is considered the same as an employee then cents-per-kilometre basis is permitted.

However, when a corporation makes an automobile available to a shareholder, a standby charge (applies when the shareholder has access to the car for personal use) and any operating cost benefit (applies when the employer pays operating costs that relate to personal use) must be included in the shareholder’s income.

Logbook

The best evidence to support the use of a vehicle is an accurate logbook of business travel. A taxpayer needs to keep a log of actual business kilometres driven.

Full logbook

The full logbook should contain the information such as the destination, purpose, and distance traveled for each trip for the entire year. Make sure to keep track of both the total kilometers driven and the kilometers driven for business income.

Keep in mind that in order to claim motor vehicle expenses, they must be reasonable and you must have receipts to support them.

For each business trip, keep a log listing the following: Date, destination, purpose, number of kilometres you drive

Record the odometer reading of each vehicle at the start and end of the fiscal period.

Simplified logbook

A full logbook for one complete year can be used to establish the business use of a vehicle as a base year, but it must be representative of the vehicle's typical usage.

A logbook can be used to estimate the business use of a vehicle for the entire year after the first complete year of keeping a logbook, as long as the usage falls within 10% of the results from the base year. If the calculated annual business use varies by more than 10% from the base year, the base year is not considered a reliable indicator of annual usage. In this case, the sample period logbook is only reliable for the three-month period it was maintained, and the business use of the vehicle for the rest of the year must be determined using actual records of travel or alternative records. In such situations, the taxpayer should consider creating a new base year by maintaining a logbook for a new 12-month period.

To determine the business use of a vehicle in the following year, a formula is used that multiplies the percentage of business use from the base year by the ratio of the sample period to the base year period. The formula is:

Calculated annual business use = (Sample year period % ÷ Base year period %) × Base year annual %.

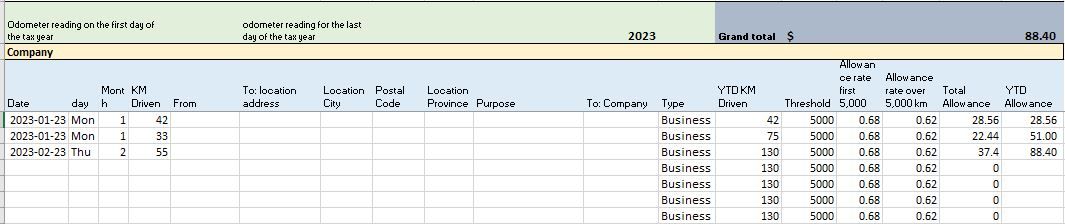

Vehicle allowance log book Microsoft Excel template

You can use the provided Vehicle Allowance Log Book template in its Excel version to record the required information for your mileage reimbursement or deductions.

Download a free template of the Vehicle Allowanc Log book for 2024, 2023, 2022, 2021, 2020 - Microsoft Excel

A formula already set up to calculate your reimbursement based on the CRA mileage rates for 2024, 2023, 2022, 2021 and 2020.

To claim your mileage deductions, it is important to maintain a detailed log throughout the year. You can use this template to log your travel whether you are an employee, a self employed individual or a corporate officer.

If you require any help or assistance with filing tax returns and you have any questions about Tax-Free Motor Vehicle Allowances, please reach out to us.

SUMMARY AND CONCLUSION

The Income Tax Act allows businesses to provide tax-free reimbursement for business-related travel expenses incurred by employees and shareholders using their personal vehicles.

To qualify as reasonable, a motor vehicle allowance must be based solely on the number of kilometers driven and computed using a reasonable per-kilometer rate provided by CRA, requiring a logbook for verification.

Strategies such as accurate record-keeping through logbooks and following the reasonable per-kilometer rates are crucial.

Maximize tax efficiency in business travel with expert insights on motor vehicle allowances, and deductible strategies. Navigate consequences, stay informed, and make smarter financial decisions.

Get in touch with me to discover strategies for optimizing your tax savings.

Disclaimer:

“Please note that the information provided in this article is of a general nature and may not be accurate for your specific situation. The information is current as of the date of posting and is not intended to provide legal advice. It's always recommended that you consult with a professional accountant and lawyer for personalized guidance and advice."